5 Huge Mistakes To Avoid When Building A Financial Plan

Number 3 could cost you THOUSANDS!

1.Trying to “go it alone”/Doing everything yourself.

Yes it’s true you can use online brokerages for stocks, bonds, ETF’s & cryptocurrencies, you could create a plan for yourself without ever meeting with a live person. Although, you may be missing the bigger picture. There are many factors to consider when doing the solo approach:

- First, What is your level of knowledge towards the underlying investment? Typically it is not a good idea to invest in something you don’t understand.

- What has been the past performance of the underlying asset?

- What kind of time can you spend managing these assets? Or learning about them?

- What kind of diversity do you want in your portfolio?

- What kind of insurances should I have?

- What level of risk are you comfortable with?

- What things am I missing?

Often when we are off on our own learning about subjects like finance, we can become overwhelmed with the abundance of information, and trying to figure out what is applicable. Also when looking at the matter of insurance, there are some insurances that are unlikely to pay out and should be avoided whenever possible (Mortgage Insurance, Credit Card Balance Protection, Anything with post-claim underwriting) When making a financial plan, it is great to have outside help, typically its good to have an Accountant, Financial Broker & Bookkeeper as people in your corner. These professionals can help you spot trends, properly deduct expenses and mitigate taxes where possible.

2.Outspending Your Means/Keeping Up With The Jones'

When building a financial plan it is helpful to be realistic and not outspend your earnings. If you qualify for a $400,000 Mortgage, that doesn’t mean you should get a house that costs $400,000… You will need to think of the costs of upkeep, furnishings, utilities, etc. It’s better to live comfortably in a modest house, than scrape by in a mansion. The same goes for vehicles, RV’s, and other luxuries. If you’re paying for these with Credit, you’re living on borrowed money. If you have car payments, a mortgage payment, credit card payments, etc. They can really eat away at any savings you are trying to build. This can be one of the biggest hurdles to overcome when you’re building a financial plan. I recommend everyone get a handle on their debt before even looking at playing around in the equity market. Especially if you have debts with large interest rates. (Ex. If you have credit cards and other debts at 20% interest investing typically doesn’t make any sense)

3.Missing Insurances

The foundation to a solid financial plan and to the accumulation of wealth is having the proper insurance in place. Savings are depleted quickly when they are used to replace income. Many people starting off on their journey towards retirement focus on their investments: Stocks, bonds, GIC’s, Etc. but many overlook one of the most important aspects to any financial plan. The insurance!

Insurance is there to cover the liabilities you create when starting your family and professional career. If you have a mortgage, business, kids or a significant other you NEED insurance. Life insurance can provide a lump sum payout for your family to pay off any debts you may have and can help them manage bills and expenses after your passing. Typically it is recommended that you have at least 10X your income in life insurance to cover any responsibilities you have (to your family, Debt holders, etc.) There are also insurances to cover a lost income through disability insurance or critical illness. Lastly, there are insurances you can get on your personal property or health. These will also help mitigate costs from unforeseen expenses.

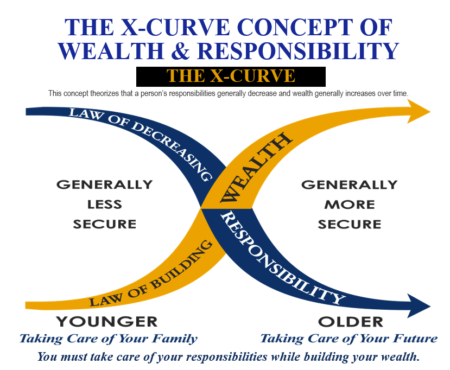

The following graphic depicts the X curve of Wealth & Responsibility. The blue line represents liabilities/responsibilities like:

- Mortgage

- Business costs

- Household expenses

- Debts

- Taking care of dependents.

This high liability can be counteracted by insurance. If something happens and you need to use the insurance, you can keep your savings in place and not have to dip into them.

The yellow curve indicates the wealth you accumulate during your life. Near the right side of the chart, you have less responsibility and higher wealth, so insurance does not play as big of a role in protection. It can however serve as a great tool for wealth transfer, as it is one of the only vehicles that pass probate.

3.Keeping all your eggs in 1 basket (Not enough diversification)

Asset classes go in and out of favor, some years it’s technology, others it’s real estate. At the end of the day, nobody has a crystal ball and can predict the future, so the best thing for us to do is DIVERSIFY. This means holding assets from different classes and regions. Don’t put your eggs in one basket, this may reduce some of the gains, but it will hedge against some of the risks you would find yourself with if you just put your money in one thing. If you were to keep all your assets in Real estate, and it were to crash, you would probably not feel very comfortable, same goes for any individual area of the market.

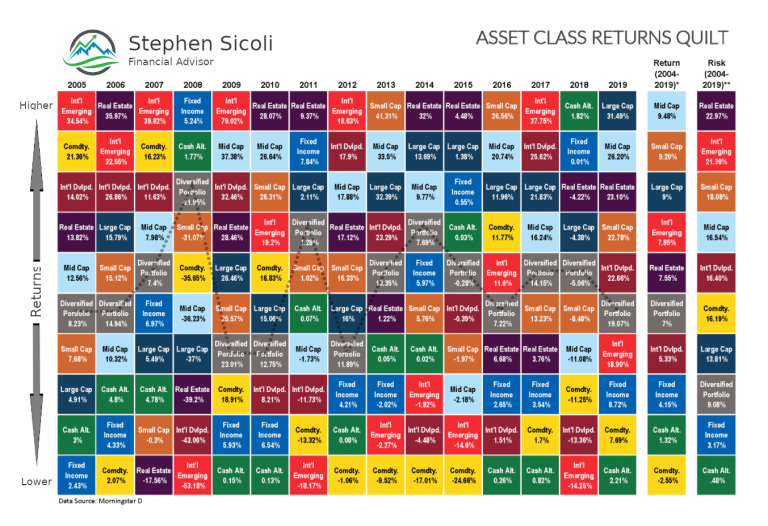

As you can see in the chart below “the quilt” or the “jellybean chart”. Different asset classes perform better in different years. There are many factors that go into creating portfolios, but as you can see, having exposure to several asset classes will help you mitigate losses while increasing potential gains.

5. Waiting

“The best time to plant a tree was 20 years ago. The second best time is now”

Many people wait longer than needed to start fine-tuning their financial plans. I have too often heard “Once I get things figured out, then ill speak with an advisor.” Or “Well I just have too much going on that I can’t look at building a plan” If you don’t have enough time to meet with an advisor. YOU NEED TO MEET WITH AN ADVISOR. A financial professional can help clarify the muddy waters of personal finance. Typically they will have a better idea of what products/services will fit your needs, and have access to resources for you to learn more.

Building a plan for your future can be a very daunting task, that is why I recommend taking small steps at gradual progress and just start somewhere.

If you are hoping to pay down your debt before investing, that is a great strategy although in many cases people spend too long paying debts down at a high interest rate. There are many strategies for reducing debt load, Including; debt consolidation, consumer proposals, and just making some simple adjustments.

At the end of the day, do your research, get educated, and get some professionals in your corner. This should help you feel more confident in creating a plan that works for you.

Like always, if you are interested in learning more, feel free to reach out or book a consultation.